All-in-One Applicant Tracking Software

Get Applicants

Get a branded, mobile-optimized career job board. We'll broadcast your jobs to top job sites like Indeed, Glassdoor, Simply Hired, and others.

Integrated Assessments

Our screening tools help you rank applicants and our selection tools help you choose between the top candidates. Take advantage of built-in validated assessments.

Track and Select

Our easy-to-use tracking software simplifies keeping track of your top applicants and moving them through your hiring process.

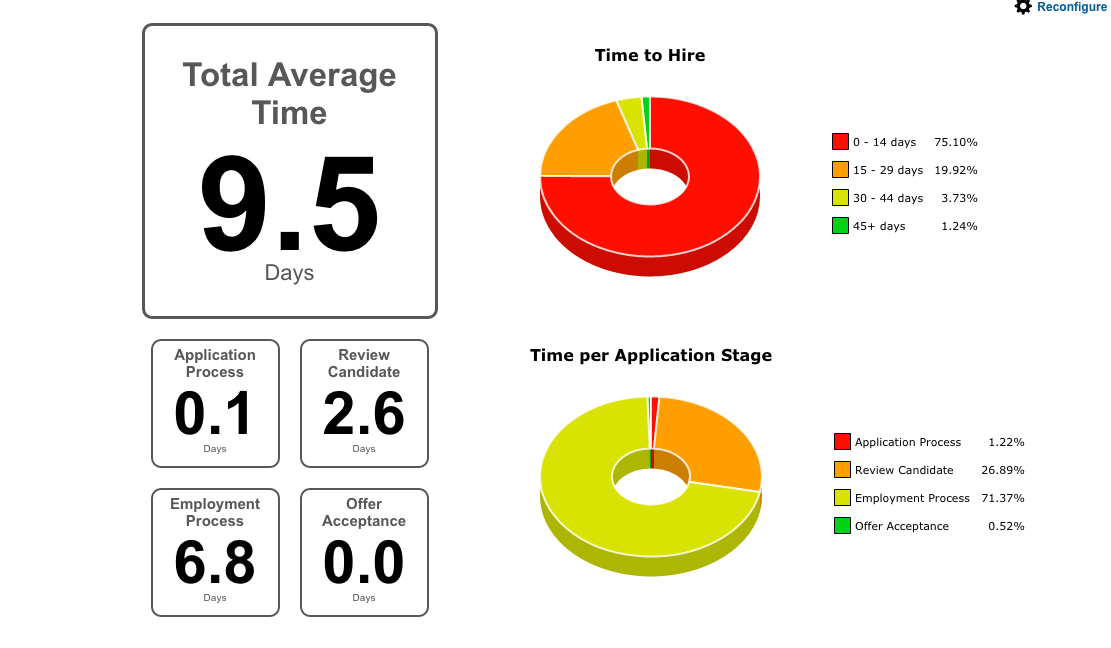

Reports and Analytics

TalentNest helps you get the essential information you need to run your HR department. Reports on Time to Hire, retention, candidate source performance, turnover — we have you covered!

Popular Features

Your Own Custom Job Board

Our fully hosted branded job board easily integrates with your career site and provides a landing page to post jobs, including internal-only postings. Your job board integrates with external online job boards to help distribute your postings for increased candidate flow.

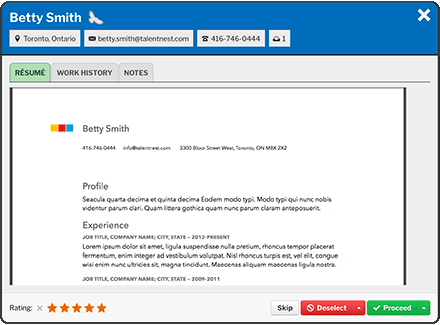

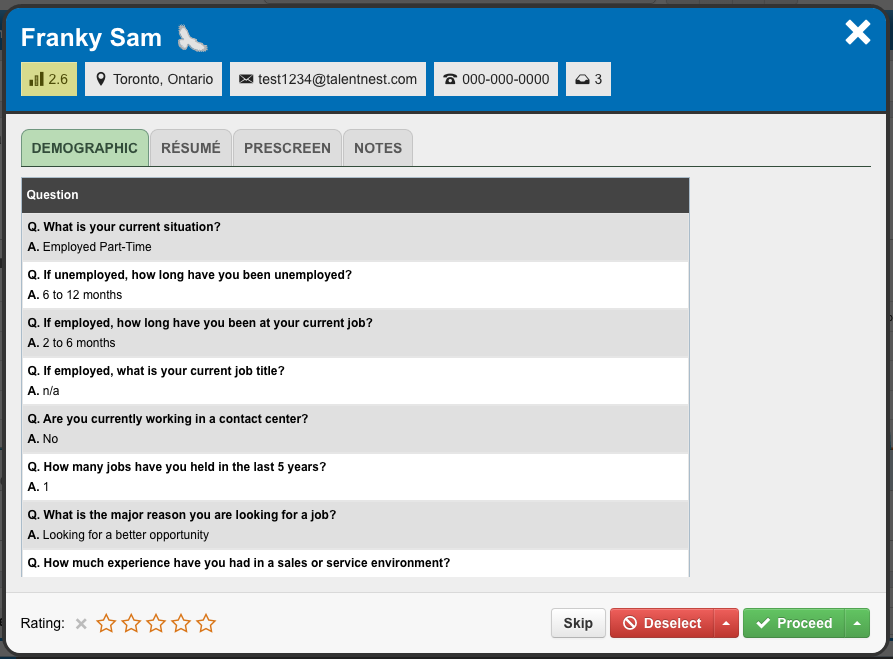

Quickly Review Your Candidates

The “Quick Review” feature is a streamlined process to efficiently move from one candidate to the next. You can review all of your candidates’ information, rate your candidates with 1 to 5 stars, deselect or proceed the candidate to the next step, and flag your top candidates as GoldenEagles™ to create a shortlist.

Check Out Some of Our Clients

See What Clients Are Saying about TalentNest

Request A Demo

Interested in TalentNest applicant tracking software? Just fill out this form to set up a demo with a member of our team!

- We’ll walk you through the system and show you how it can work for your company.

- You’ll have the choice of booking a 15 minute demo or a longer webinar.

- View the demo remotely and at a time that suits you.

- Get pricing information based on your company’s size and number of recruits per year.